Table of Contents

Introduction to Financial Success

Fulfilling life goals requires the financial means to sustain in the pursuits of one’s passions. It should be noted that of the many goals life encapsulates, dreams and aspirations take incredible prominence. Personal financial satisfaction is but an umbrella of dynamics that stimulate self-defined fulfillment. Allow me to illuminate this enigma.

What if I told you that the only reason standing between living life as you wish in luxury and free from the anxiety of bills and debt is ample financial precision? By taking actionable decisions around a thorough understanding of managing finances, you can carve towards achieving precision in the achievement of economic aims.

Diving into this blog post, we will unravel strategies and insights relevant to personal finances, to ensure your uncertainning route towards succuess on all fronts is bolstered. Regardless of whether you are well versed or clueless regarding budgeting or have identified touchpoints needing to be integrated into a plan, it is hoped this piece will provide enable a step towards empowerment fostering economic independency for sustainable growth.

The Importance of Setting Goals and Creating a Plan

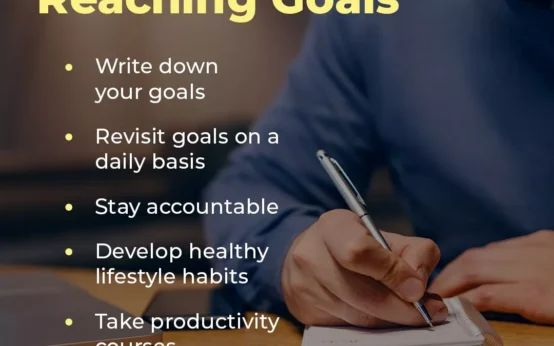

Establishing objectives paves the way towards achieving greater financial management. If there are no set goals, it is alarmingly effortless to float aimlessly in the sea of finance. A goal provides the individual a reason and helps them steer in the correct direction.

Pursuing these goals and translating them into plans provides step-by-step tasks that can be incorporated into a busy schedule, instead of life being busy around these endeavors, which is stressful. This not only keeps the individual organized but also promotes tangible development towards achieving the desired goals.

Moreover, having specific targets can improve one’s motivation level. Seeing oneself closer to their set target reinforces positive measures and supports consistency in financial management.

Accomplishing a financial target becomes astoundingly easier through actionable goals. A financial goal must always be transparent, which in turn births definable steps and the right endpoints to help shape the individual’s thoughts as to where his/her focus is and where to go next. Embrace freedom, draw out your boundless journey unshackled from tiresome standards.

Clarity allows the individual to construct tailored step reimbursed action plans intended to suit personal needs within the financial blueprint. It encourages the user to aim at obstacles rather than letting them hinder their objectives.

The surge of emotions attached to the result allows the unshackled individual to strive past what was previously assumed to be a reasonable cap, thus allowing infinite expansion towards achieving goals set by the individual, enabling full customization towards moving further without running blindly.

The invincible blueprint combined with determination and tenacity forms the user, making the user soar, which shatters glass ceilings and helps harness the power of expansion against the target, therefore aiding in free self-defined innovation.

Starting from identifying a single step boils down to crafting tangible achievement windows and turbocharging personal innovation through limitless leap-and-bound steps.

Strategies for Saving and Investing

Two of the major determining factors of an individual’s financial well-being are saving and investing. First and foremost, if you are just starting, consider automating your deposits. Apart from easier ways to save, turning deposits into an automated process makes saving effortless!

Before automating your deposits, outline a budget and adopt methods to track your expenses to the smallest detail. By controlling your spending, you are crafting a pathway to pinpoint areas of spending that can be reduced or eliminated. Even the most minuscule changes can, over time, add up to significant savings.

When shifting to the investing stage, begin with ETFs or other index funds that align with your risk appetite and goals. At this early stage, remember, everything is a step forward; therefore, ensuring diversification is essential.

Have a proactive attitude and keep on learning about the variety of options on the market so you can make the best decisions.

Last but certainly not least, remember, wealth stems from discipline and effort; therefore, consistently exercising patience when saving or investing is crucial.

The Power of Compound Interest

Compound interest is considered the eighth wonder of the world because of how effective it is at enhancing one’s finances over time. The underlying concept, as outlined later in this segment, is simple.

Whenever an individual invests money, they receive interest not just from the original amount put forth, but on the interest itself as well. They have likely amassed over time, courtesy of the system.

The damage or enhancement that interest does to one’s investments gets further escalated if the individual starts investing as early as possible. Small amounts, if granted time, tend to result in heavy returns and therefore, get dividends in the much longer timeframe.

Achieving financial literacy requires grasping this principle, alongside considering it as a benchmark to measure one’s savings and investments, all of which are considered the crux of enabling growth.

If it is visualized as sowing a seed, it would need plenty of patience along with unwavering faith to watch as it grows into something massive. Compound interest leads to a paradigm shift in how investments and savings should be regarded.

Managing Debt and Credit

Keeping track of debt and credit is one of the cornerstones of attaining an individual’s financial goals. In order to make progress, there first needs to be some review that defines the current state of affairs. Gather all financial obligations, including credit card debts, education loans, or mortgage loans, and evaluate their total monetary value.

Next, define short- to medium-term priorities and elaborate on the most effective strategies for managing these objectives. Allow payment plans for high-interest debts to be adequate and manageable within the given financial constraints. Pay plans should be designed in a way that contributions can be made regularly without causing additional strain elsewhere.

Revisiting arrangements with creditors might yield favorable results. It is likely they will offer better interest rates or amended terms of payment if approached properly.

Tracking movements of one’s credit score continuously assists a person in these goals, and in this case, staying within set limits. Timely payments, as well as maintenance of account balances, add reward points to the score, which improves it in the long run.

New credit obligations should be avoided personally. Every action taken financially impacts, for better or worse, the person’s potential growth and stability in the future.

Creating Multiple Streams of Income

Cultivating parallel projects can enhance one’s financial stability. A paycheck at the end of the month is often insufficient for meeting goals and expectations.

Think about expanding to the realms of side jobs such as copywriting or graphic designing if your skill set permits creativity. In this technological era, advertising one’s skillset has become uncomplicated.

The ever-popular industry of real estate can be looked into as well. Rental properties are deemed fruitful as they guarantee steady income during the month while simultaneously increasing equity.

Savings accounts and stocks also provide passive income. Income gained through the means mentioned above from reliable businesses requires additional time and effort. However, the reward is great.

Digital products are often overlooked. E-Books and online classes not only allow one to share valuable content with others but also make income without much effort.

Finding something that aligns with your natural skills as well as interests while remaining forward-adaptable is the challenge.

Overcoming Financial Obstacles

Financial problems can seem insurmountable. Confronting them directly is the best approach.

Start by determining the challenge you wish to tackle. Is it an accumulating debt problem, or is it exorbitant expenditures? Identifying the challenge makes it easier to come up with a solution.

Next, set a realistic budget in relation to your income and spending patterns. This should highlight the areas where there is wastage and how funds can be better allocated.

Do not emphasize the need to look for assistance. Financial counselors or support groups provide invaluable help and motivation. Join people who inspire you to focus on goal attainment.

Maintain an adaptable approach. Since life is dynamic, your methodologies can change with context while leaving the desired outcome constant.

Do not forget about the significance of incremental changes. Every small achievement sends motivation signals into one’s psychology and can be rewarding.

Monitoring and Adjusting Your Financial Plan

Concerning the financial plan, it is paramount not to regard it as a one-off event but as a phenomenon that develops over time. Periodic check-ins help in understanding what changes need to be made and ensure that life transitions are accounted for.

Start by evaluating your goals every quarter. Are these still relevant? Changes in life, such as a new job or a growing family’s foray into the picture, usually recalibrate priorities and shift importance. Adjusting your goals and targets helps in keeping balanced with modern-day shifts.

You can use numerous spending tracking apps and income tracking spreadsheets to help with tracking your expenditures and income in real time. With these assisted tracking systems, identifying economical spending and income-generating locations becomes much easier.

Don’t refrain from seeking enhanced professional help when necessary. With these financial experts, fostering novel perspectives unique to your desired outcome becomes possible.

Flexibility, while adapting to life’s many intricate choices, is availed to you as a gift that the explorer must grasp freely. From shifting market standards to personal lifestyle changes, embracing the need for change aids in the evolution of progression. Ensuring modification around finances aids immensely in growth-directed journeys.

Celebrating Milestones and Staying Motivated

Recognizing milestones is paramount to achieving financial self discipline. Achievements should be celebrated with permission, more stick to the positive nature awards. Everything fuels motivation.

Self-love is also needed for staying motivated, so consider treating yourself after repayment milestones, savings milestones, etc. These moments do not always have to happen on a grand scale; spending time on a guilty hobby, enjoying dinner in, or skipping a weekend getaway can also yield delightful results.

People often lose motivation due to a lack of positive external forces. Ensure you have an ample amount of positive-reinforcement people along the journey. These will help stick with sharing the goals and the progress. Positive people’s excitement is contagious.

Visual motivation works wonders to aid further staying motivated. Create impressive charts marking the milestones achieved, as well as place vision boards showcasing current aspirations. The boosters of visual motivation work when one seeks pictorial reminders of the astounding progress made.

Strengthening motivation is crucial to uphold focus, alongside grit. Each stride taken is equally important as the boost one’s confidence receives.

Conclusion

Achieving new milestones in your financial journey is within reach. Accomplishing something as complex as an economic vision requires careful strategizing, successfully executing well-constructed plans towards tangible results, and harnessing smart resource allocation alongside investment strategies.

The basic understanding of savings can make your reality views alive when juxtaposed with the power of compounding interest. Saving is transformed into a vehicle towards financial freedom when envisioning turning money into a powerful legion ready to seize opportunities. Supporting debts can very well help charge this vision towards stronger credits and investments, which aid in carving the backbone towards future financial freedom.

Strengthening one source of income ensures a sustainable approach towards lessening dependency on alternative means while powering up renewable resources engineered for untapped growth. This simultaneously locks down prospective windows ripe for post-storm resilience.

Having personalized goals set towards achieving every opportunity regardless of their entailed checklist fosters determination while unlocking enduring self-motivation, enabling you to conquer diverse niche fields while dealing with other people who challenge sparks.

Acclaimed and unrecognized achievements aid you in realizing that every single notable milestone, regardless of the subjective scopes they tackle, helps shift your image towards appreciation while unlocking continuous self-motivating growth, catering to all elements of your finances positioned towards a brighter digital future.

These principles will provide sustainable financial health and previously inaccessible opportunities. While the journey may be convoluted at times, unwavering resolve and meticulous planning will make the attainment of economic prosperity increasingly accessible.

OPTIMIZING PRODUCTIVITY: Proven Goals for Lasting Success

OPTIMIZING PRODUCTIVITY: Proven Goals for Lasting Success