Table of Contents

Introduction to Credit Scores

Understanding your credit utilization score can seem like a journey through a labyrinth. This part of your finances is very important and can even be termed as an indicator of your financial health, yet it is still confounding as well as complicated for many people out there. At Traceloans.com Credit Score, we are prepared to eliminate the confusion stemming from this number, which is significant for not just loan approvals but intervals and other places, too. Whether you wish to buy a house, you want to take a car loan, or if your aim is improving your credit score, knowing the credit score system is essential. Let us discuss in this article the importance of credit scores and how you can refocus it to secure a stable financial future.

Why Your Credit Score Matters

You need to be responsible with your credit because it impacts your financial lifestyle. Your credit score reflects how reliable you are as a borrower, and it has a direct impact on your loan eligibility. SCORING HIGH ON THE TEST OR CREDIT SCORING Checking all sales, lender access to lower interest rates and different loans will become easier. It will also ensure that your financial requirements like home and auto loans will not sit on standing by his bank accounts come to value.

A credit ranking below average has its consequences as well. It is based on percentage; thus, a mortgage loan application may result in rejection or expensive add-on dealings.

Additionally, rental properties also require tenants to possess good credit scores. Renters using Windows to sell credit will find easy access.

In the hyper-connected digital landscape, credit scores determine other tangential aspects like hired candidates, sponsored risk, and entrusted insurance deals. So with utmost precision, calculation – should be done keeping strong banking health in focus.

Factors That Affect Your Credit Score

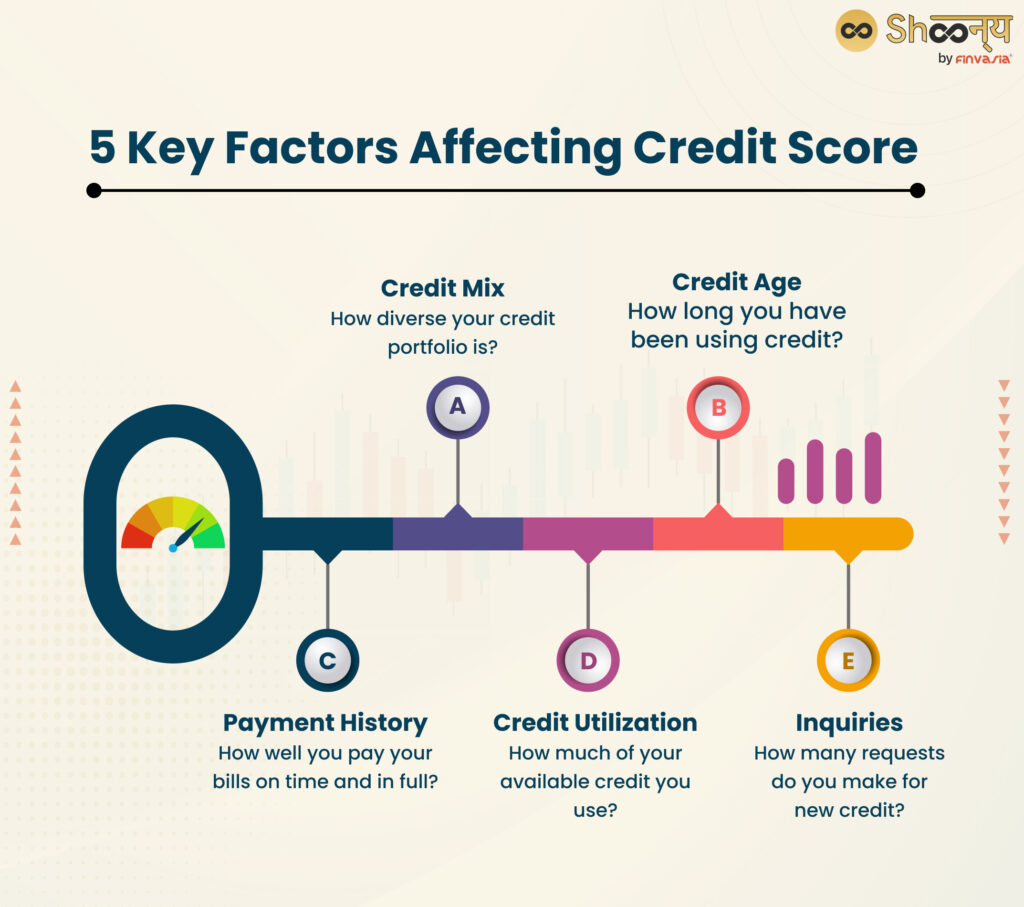

Multiple factors affect your credit score, from payment history and credit utilization to the length of your credit and the type of credits you possess.

Your Score is affected the most by your payment history, which consists of paying bills each month without defaulting. Prompt payments on bills will significantly uplift your Score while missing payments will result in negative damage to your Score on a long-term basis.

Your Score will also be affected positively by responsible borrowing behavior, which is showcased through your credit utilization ratio—the current loan amount you have vis-a-vis the credit limit you possess. Strive to keep this value below 30% to avoid damaging your Score.

Newly opened accounts can be viewed as a risk, so adding accounts should be done cautiously and within set limits—it is good to open them periodically. Older accounts strengthen your Score as they represent increased risk stability.

Along with payment history, another factor that is crucial is the type of credit.Injecting an installment loan or a revolving credit card can further enhance your score, thus aim for this combination blend.

Having too many credit applications can lower your credit rating because of its hard inquiries, which adversely affect your score; so avoid making many applications. If the need arises, space out the applications over a considerable length of time so as not to suffer negative peripheral damage.

Understanding the Three Major Credit Bureaus

Each one performs particular duties that are quite vital in measuring certain granular details pertaining to your financials.

Experian profiles credit risk in detail and provides powerful analysis tools for lenders, as well as handing consumers solutions to manage and control their credit.

TransUnion emphasizes identity and fraud issue protection. They have services that notify you of anything suspicious concerning your activity on your accounts.

Equifax compiles extensive information on your borrowings and public records about you. Their reports are instrumental to granting credit since they have a large impact on credit decisions.

Knowing such record-keeping details is important as one can borrow freely without having to think about these clients. They can operate knowing how best to take advantage of these amenities, thus improving their financial health and credit rating on Traceloans.com.

How to Check and Monitor Your Credit Score

Getting credit reports gives users an insight into the finances which helps them plan accordingly, demonstrating the importance of checking one’s credit score. One can obtain credit reports from the main credit bureaus, Equifax, TransUnion, and Experian, who set rules and regulations for retrieval of one free report each year.

Detailed online platforms such as traceloans.com offer comprehensive reports and score-tracking features that can help people track their financial health continuously. Being aware of one’s Score and having set goals helps improve self-driven discipline in decision-making with respect to finances.

Those who proactively protect themselves against identity fraud will greatly benefit from their ability to monitor and receive alerts for new inquiries made under their identity as well as other significant changes being made to their Score.

Mobile phone budgeting apps with credit tracking tools have greatly simplified the tracking and monitoring process.Such budgeting applications with credit score features typically offer tailored advice on addressing shortfalls which in turn, makes proactive credit score monitoring and management easier than ever before.

Tips for Improving Your Credit Score

With the right mindset, almost anyone can improve their credit score even if it takes some time. A lot of it comes down to changing a few everyday habits and following through. Make it a priority to pay all of your bills on time because a late payment can have a sharp negative impact on your credit score.

In addition, try to keep your credit utilization low, ideally below 30% of available credit. Your lenders will appreciate the fact that you are managing your debt properly.

Also, think about changing or adding other accounts to your loan portfolio – having both revolving and installment loans can positively affect your profile, provided they are used responsibly.

Consider auditing your credit report on a routine basis to look for discrepancies and inconsistencies. Correcting them can be very beneficial.

Avoid opening new accounts too frequently. Each hard request can reduce your Score temporarily, so if you can, try to limit applications and be strategic whenever possible.

The Importance of Maintaining a Good Credit Score

Having a good credit score goes beyond having just a number attached to it; it shows responsibility for one’s finances, which helps in getting a home or loan services at better rates and sometimes even lowers interest rates.

Credit score units are available based on how frequently a loan is provided and paid back, so if a borrower’s Score is higher than lower, they are considered a lesser risk to deal with. Hence, they will decrease the number of units charged overtime to pay, helping them save in the long term.

Many loans tend to charge higher rates of interest, and having good credit can reduce the cumulative expenditure of having to pay multiple loans.

No one likes to be stressed. Having good credit tends to eliminate that stress from one’s brain, allowing a clear mindset to address other problems and bringing ease to deal with unplanned financial traumas in the future.

A positive credit history comes in handy when scoring employment or getting accepted for an insurance plan. Months of preparation to ace the job can result in savings while still actively undergoing the savings when signed into insurance at the same time.

Conclusion

Understanding the intricate details of one’s credit score is vital for establishing a foundation into financial well-being. A dip or rise in one’s score affects practically all aspects important to an individual’s finances, for example getting loans and even paying insurance premiums.If a person recognizes what determines his or her scores and makes an effort to control them, the chances of getting better financial options improve.

As stated before, checking and managing your credit score on a routine basis is important. Staying updated on current developments is critical and enables one to rectify any inconsistencies at the earliest possible moment with the available online tools like those found on Traceloans.comCredit Score, dealing with this nuance of finances has become a stroll in the park.

Improving and retaining a reasonably high score requires equal measures of commitment and knowledge. Employing sound financial management strategies like paying bills on time, lowering debts, and maintaining a positive mix of used credit accounts is beneficial in the long run.

Good credit is the gateway to more opportunities. From accessing new credit lines to obtaining loans at lower interest rates and even enjoying reduced insurance premiums, a person stands to gain so much more. Paying attention to these variables could go a long way in promoting better overall health and leading to improved financial well-being.

You will be better prepared to grab tomorrow’s opportunities by starting your credit journey today. Once you learn how to navigate the indecipherable web of credit, you’ll start making decisions that will propel your future financial undertakings.